|

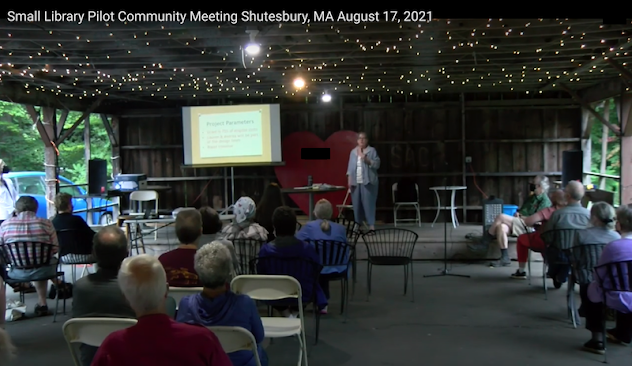

| Photo: shutesburyschool.org |

What I found was a pattern of patchwork repairs to a school roof that needed much more extensive work. Though many town officials noted the need for a more thorough scope of work–up to and including replacement–the project seemed to drop off the radar of Shutesbury’s government leaders for long periods. In addition, the town spent many years applying for grant aid for extensive repair and/or replacement, assistance that was denied. Meantime, the Town Buildings Committee took on the responsibility of monitoring and repairing the SES roof in response to each new problem.

A History of Deferred Maintenance

Shutesbury’s reluctance to address maintenance and repair of its public buildings is well-documented. A grant-funded study on Community Resilience Building published in 2020 noted that “Workshop participants stated that there is roof damage at almost every public building in Town. The roof of the Old Town Hall, where Town records and archives are stored, has caved in.” The Fire Department and Town Hall were also identified as buildings with leaking roofs.

The Town of Shutesbury Hazard Mitigation Plan of 2021 notes, “The roofs at the elementary school, Old Town Hall, and Highway Department salt shed are in need of repair.”

When I asked the BC Chair about these problems, he told me that the Old Town Hall roof did not collapse, is solid, and that the Committee is not aware of any roof issues at the Fire Station. The Town Hall, where the roof was recently replaced, had a leak surrounding the chimney flashing; that has been repaired and a chimney cap installed. The roof at the Highway Department salt shed was repaired approximately three years ago.

Piecing together the SES roof story shows both the Select Board (SB) and the Finance Committee (FinCom) were aware of roof leaks at the elementary school by 2010 and 2011. The FinCom noted that suggested roof replacement costs of between $700,000 and $1,000,000 were “purely speculation” and that when replacement was necessary, the job “will likely be eligible for state grants.”

The FinCom continued to acknowledge, in its Annual Reports for Fiscal Years 2016 through 2022, the need for continued maintenance on the 40+-year-old SES building. The fiscal year 2018 report notes a capital outlay of $300,000-plus for the school roof that FinCom expected to be on a Special Town Meeting warrant in Fiscal Year 2019. I could not find a record of that warrant article or a vote, however.

State Aid Denials Stall Action on SES Repairs

The “Upcoming Capital Projects” section of FinCom’s annual report for Fiscal Year 2020 estimated the SES roof project at $1,000,000 after noting “grant funding denied”. For FY2022, Annual Town Meeting approved $254,100 for phase one of the SES roof project as well as up to $200,000 to update controls on the SES heating system. In its year-end report, FinCom estimates phase two at $600,000. Also in the works is another costly SES upgrade: a new ventilation system, estimated to cost between $175,000 and $350,000. The ventilation project and the second phase of the roof replacement are on tap for next year (FY2023).

The grant funding mentioned time and again refers to the town’s fruitless efforts to secure aid from the Massachusetts School Building Authority (MSBA) for improvements to the SES roof as well as the heating, ventilation, and air conditioning system (HVAC).

My information request yielded applications to the MSBA’s Accelerated Repair Program and their subsequent denials for the years 2018 through 2021. The first request was made in February 2014 and presumably denied; the town had no record of this request.

The town’s insistence on submitting requests for funding prevented lasting repairs from being performed on the school roof for many years. Instead of accepting the fact that aid was not forthcoming, the town continued to postpone any substantial SES roof projects for several years–even as Shutesbury’s cash reserves continued to grow. Meantime, the Town Buildings Committee, whose Chair is a Massachusetts licensed construction supervisor, took the initiative to address each new roof problem on a case-by-case basis.

Volunteers Address Chronic Leaks at SES

Since at least 2010, Town Buildings Committee (BC) members, particularly the Committee’s Chair, have taken the initiative to maintain the SES roof and arrange repair work when leaks occur–something that has happened numerous times, according to BC minutes.

The available BC minutes on Shutesbury.org spanned mid-2015 to the spring of 2021. The minutes recounted many incidents of roof leaks at the school and the repairs and preventive maintenance work organized by the BC Chair and other committee members. Ice dams, an issue acknowledged by the Select Board in 2011, continued to cause leaks during the winter and spring months. A local roofing company, Hayden Roofing, often performed repairs as well as maintenance in the fall to fortify the roof for the upcoming winter.

After extensive repairs were completed in the fall of 2016, more leaks occurred in March of 2017. The BC agreed that a new roof needed to be installed by 2018. The roof suffered from chronic leaks through 2017. In December, the BC agreed that repairs were not sufficiently addressing the problems and were not cost-effective; the town should “move forward with roof replacement project and grant application.” On October 25, 2017, Shutesbury’s free cash balance was $1,253,860 and stabilization fund balance was $1,045,294.

Leaks continued into 2018. When the grant was denied by the MSBA in June, the committee agreed to consider resubmitting the grant application as an option, noting the “Town should proceed with plan to replace roof without grant.” On October 16, 2018, Shutesbury’s free cash balance was $1,253,057 and stabilization fund balance was $582,503. The Buildings Committee began discussions with Tom Ewing, Roofing Consultant. At the July 10, 2018, SB meeting, the Shutesbury Town Administrator (TA) announced, “an appraisal for the complete replacement of the SES roof is in process.” There is no further mention or record of this appraisal, however.

By May 2019, the third grant request was denied and stopgap measures to control leaks continued. On October 18, 2019, Shutesbury’s free cash balance was $1,389,680 and stabilization fund balance was $710,795. In February 2020, the TA, who often attended Buildings Committee meetings, stated that another grant request had been filed with the MSBA. The BC Chair noted that there needed to be a “Plan B” to replace the SES roof if MSBA funding did not come through. The grant request was denied on June 3, 2020, according to information supplied to me through the Town Clerk’s Office. On December 2, 2020, Shutesbury’s free cash balance was $1,378,767 and stabilization fund balance was $829,616.

The Town filed its latest request for grant money from the MSBA on June 1, 2021. The October 27, 2021 refusal marked the fifth time in a row Shutesbury was denied aid from the MSBA (source: Shutesbury Town Clerk’s Office). Our town has the funds to replace the roof. Why is this not being taken care of? Aside from the children, the roof is the most important part of the building. Why do we continue to send our children to a school with a leaky roof?

Heating and Ventilation Problems at SES

In addition to the roof problems, the heating system at SES has been balky and needs assessment and upgrading. The June 12, 2021, Town Meeting approved a heating, ventilation and air conditioning (HVAC) study as well as upgrades to the present system. The FinCom has acknowledged the need to set aside money for a whole-building ventilation system–which may also include air conditioning–though the town hopes that state money might be available to defray the costs of such a project.

In the next post, I’ll take a look at why it took so long for town leaders to recognize the need for extensive repairs at SES.

Weekly Factoids:

School building conditions and their effects on students:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2920982/

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6360122/