|

| MBLC Building Specialist Lauren Stara Discusses the Small Library Pilot Project |

Early next year, the Massachusetts Board of Library Commissioners (MBLC) will decide which town, Shutesbury or Otis, will receive the Small Library Pilot grant. This program, the first of its kind in Massachusetts, was designed for towns with 2,000 or fewer residents. According to the May 6, 2021 news release introducing the program, these towns are generally underrepresented when securing construction grants from the MBLC due primarily to the high costs of construction.

The release states that 46 small towns were eligible for the grant, yet only four towns submitted letters of intent. Two towns have since withdrawn from consideration. Did the MBLC misread the appetite for such a project? With the state now funding 75% of eligible costs compared to the usual 40% to 50%, providing increased technical support, and streamlining the process, it is surprising that few communities expressed interest.

One reason why there was not wider participation could be that this project was designed to favor Shutesbury as the program’s recipient. I have outlined the reasons why I believe this to be the case below. Taken together, I feel they indicate a predisposition to awarding this grant to Shutesbury despite the town’s history of opposing library construction projects–or, perhaps, because of it.

The Project’s Workload and Timelines are Daunting

Though the Pilot Project was created to help small towns navigate the complicated process of building a new library, the work is arduous. The sheer volume of documents listed on the MN Spear Small Library Pilot Project page is dizzying. The Trustees, Library Director, Friends, and volunteers have put an enormous amount of work into creating these documents, some of which are quite lengthy. Add to this the compressed timelines dictated by the MBLC and it is obvious that this is a herculean task.

In October, I emailed Lauren Stara, MBLC Building Specialist, asking why so few towns expressed interest in the program despite the additional financial and technical support offered by the Pilot Project. She replied:

“We are not surprised at the small number of applicants, and we think there are good reasons for this:

The project is new construction only (many towns have historic buildings that they wish to preserve)

The rapid timeline

The amount of work involved in a major capital project (we think this is why two of the four towns have dropped out already – they realized how much it would take, even with increased help from us)”

This response belies the concept behind the Pilot Project, which is to make the grant process easier for small towns. Why create a targeted program with many of the same roadblocks that have historically kept small towns from participating?

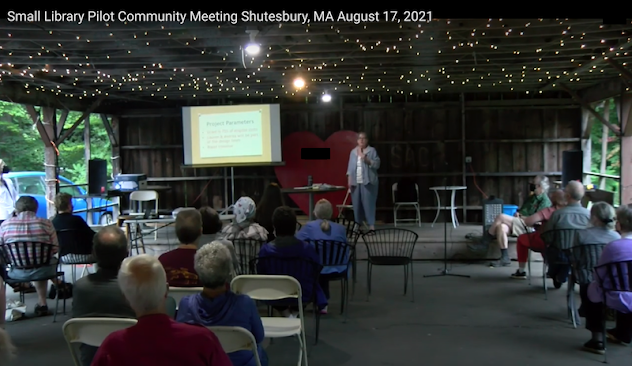

These hurdles appear less consequential for Shutesbury. Ms. Stara noted at a meeting with Shutesbury’s Select Board on August 3 that “Shutesbury worked hard on grant applications twice before” and “the first step is to write a library building program; having written a program in the past, Shutesbury is in a good position”. Ms. Stara obviously has sympathy for those involved in trying to secure the library construction grant ten years ago. While introducing herself at the Small Library Pilot Community meeting on August 17, Ms. Stara mentioned her involvement in “the last grant round that Shutesbury valiantly tried to pass a grant in (sic)”.

Shutesbury also has the advantage of a full-time Library Director. Of the 68 Massachusetts towns with populations under 2,000 six have Library Directors who work 35 to 40 hours per week.

When I spoke with the Library Director in Otis several weeks ago, she speculated that the Pilot project entailed a lot of work complicated by truncated timelines that part-time Directors might find too much to handle. She noted that small towns like Otis, Chester, and Florida have Directors whose salaries are often supported by grants and donations, not by the town’s taxpayers as is the case in Shutesbury (on line 146).

The MBLC and Shutesbury Share an Especially Cozy Relationship

Shutesbury Library Director Mary Anne Antonellis has a longtime association with the MBLC Board, dating back at least to the last grant round when she worked with Ms. Stara. The friendly relationship between the two is obvious. In addition to Ms. Stara’s comment about Shutesbury’s “valiant” efforts ten years ago, she responded to a resident’s call for “staff space” at a new library with the statement, “We’ll get Mary Anne an office.” This comment referred to Ms. Antonellis’ belief that a Director’s office is controversial in Shutesbury–a concern she voiced at the October 14 info session regarding space allocations in the library building plan.

Ms. Antonellis had been involved in the Pilot project long before the MBLC made its announcement in May. In her December 12, 2020 Director’s report, Ms. Antonellis noted that she had attended a meeting about the MBLC’s library planning tool, Library Space: A Planning Resource for Librarians, the same guidebook mentioned by Ms. Stara at the August 17 community meeting. Ms. Antonellis said she had “participated in reviewing this plan as it was developed”, a process that lasted over a year, according to Ms. Stara. Ms. Antonellis also referred to her involvement with the Pilot Project in her report of May 8, 2021, saying, “The potential to move forward with this long-discussed project is here.”

Ms. Antonellis was given space in the MBLC’s Pilot Project news release to plead her case for Shutesbury, the only Director quoted of the 46 towns deemed eligible for the Pilot Project. She also sought the MBLC’s feedback while developing the language for Shutesbury’s 2021 Town Meeting Warrant Article 9, which requested permission from voters to apply for and use Pilot Project funds.

In another favorable development for Pilot Project proponents here in Shutesbury, Karen Traub, a former Shutesbury Library Trustee who was active during the last grant round, was recently appointed to the MBLC by Governor Baker. Although the Board itself will not be voting on which town receives the Pilot grant, it is certain that Ms. Traub will be advocating for Shutesbury in her new capacity as Commissioner.

Pilot Project Requirements Favor Shutesbury

Some of the criteria listed in the MBLC’s Program Notice to rank towns regarding Pilot Project eligibility are clear, such as “financial stability of the municipality, its bonding capacity, and any financial reserves”. Shutesbury is particularly favored in the area of cash reserves, outpacing area towns and causing some residents to move to lower cost of living areas in its zeal to prop up its Free Cash percentage to nearly 20% of its annual budget.

Others are somewhat vague, such as the “demonstrated community readiness and support for a major capital project” criterion. I received some clarity on this recently, through an email exchange with Ms. Antonellis.

I asked her why, according to the MN Spear Small Library Project page, voting on this project at the Annual Town Meeting rather than at a Special Town Meeting in the fall was characterized as strengthening our application. She replied that such a move fulfilled the above criterion because “We showed ‘community readiness’ by asking for permission to pursue the grant at Town Meeting. We were both informed and organized enough to write a warrant article, and have it approved by the Trustees and Selectboard.”

The logic of this explanation seems a bit shaky. For instance, the warrant article was written by a handful of people with assistance from the MBLC, so Boston knows it does not reflect the “readiness and support” of the community at large. Neither was the Town Meeting vote itself. Of the 1,494 registered voters in town, a total of 219 (just under 15%) signed in to vote at Town Meeting. Fewer still voted on Article 9, since many had left or were leaving by the time that article reached the floor. Notably, of the 29 articles on the warrant, 22 passed unanimously; Article 9 passed with a “clear majority”.

In addition, the article does not speak to any costs related to the Pilot program, never mind a major capital project. In any case, as long as a town had administered the vote by the deadline of November 19, there should have been no advantage to procuring a vote months ahead of that date.

It should be noted that on June 12, Town Meeting voted on this article without any prior knowledge that another new library project was on the horizon; in fact, Trustee minutes from their meeting of April 12 show June 12 as the date when “we will introduce the town to our plan to apply for the MBLC Pilot Grant Project”. Shutesbury taxpayers were introduced to the concept of the Pilot Project and Shutesbury’s plan to participate in the program on the floor of Town Meeting with Article 9.

The MBLC Plans to Use Shutesbury to Take its Planning Model Nationwide

As a replacement for the Wisconsin Library Building Project Handbook, the MBLC’s Library Space: A Planning Resource for Librarians was touted by Ms.Stara at the August 17 community meeting as the new, go-to manual for public library planning and construction not only for Massachusetts but for the entire country. Both MBLC Building Specialists Andrea Bunker and Lauren Stara are credited authors on this guide, and the Pilot Project will be using its principles throughout the planning and building of a new Pilot Project library.

As a testing ground for its new handbook’s precepts and a prototype of a possible new library construction project type, the Pilot program is very important to the MBLC. What would be better than choosing a subject town with name recognition, where a legal fight over a failed library vote was covered by Boston media outlets as well as news media worldwide? It would be a coup for the MBLC if it could prod such a recalcitrant community into accepting the Pilot grant. What a wonderful marketing tool for its new planning guide!

Whether you agree with my assessment or not, the most important aspect of this scenario is that Shutesbury voters will have the last word. Will we use our cash reserves or vote for a debt exclusion override to fund this project? We will be asked to do one or even both of these things at Shutesbury’s 2022 Annual Town Meeting next spring, and at the ballot box shortly afterward. Staying informed on this important issue and attending Town Meeting will ensure that the will of the people of Shutesbury, not the MBLC, prevails.

Weekly Factoid: Christmas Edition

If you are looking for a different perspective on Christmas this holiday season, treat yourself to a reading of The Battle for Christmas by former UMASS history professor Stephen Nissenbaum. Ho Ho Ho!

.jpg)